Retailers are recalibrating their methods and investing in revolutionary business models to drive transformation shortly, profitably, and at scale. Save time, reduce danger, and create capacity to support your organization’s strategic aims. The path from conventional to trendy accounting is different for every organization. BlackLine’s Fashionable Accounting Playbook delivers a proven-practices approach that will assist you establish and prioritize your organization’s critical accounting gaps and map out an achievable path to success.

Instance 3: Unallocated Receipt From A Buyer

Furthermore, including these payments to the current mounted asset will undoubtedly skew the asset value. You can shut your suspense account as soon as the asset has been delivered and the payment has been accomplished in full. Assume of a suspense account as a quick lived holding house for transactions you should examine. Perhaps you received a cost but aren’t certain which buyer despatched it, or you’ve got an expense that doesn’t fairly add up. Instead of making rushed choices that might mess up your books, you can park these mysteries in a suspense account till you determine out where they belong.

Query About Gst Suspense Account

Generally, amounts or prices are put into what’s a suspense account a clearing account after which these respective payments are moved or transferred right into a more applicable account afterward. Clearing accounts are additionally used to verify the continuing quantities of bills and income. Both of those amounts are recorded in a well timed manner in order that the accounting is as accurate as attainable. Likewise, if you pay greater than the required amount, the additional cash will be funneled into a suspense account the place it’ll keep till it’s put towards another cost.

Jarrard, Nowell & Russell, LLC is a licensed impartial CPA firm that gives attest services and Archer Lewis, LLC and its subsidiary entities present bookkeeping, tax and advisory companies. Archer Lewis, LLC and its subsidiary entities usually are not licensed CPA corporations. There’s comfort in understanding that you’ve a system for dealing with the sudden. Nonetheless, if you had been unable to observe any steps, you ought to not hesitate to contact a professional. For tax-related concerns, check out our Assist Articles in your reference.

What’s A Basic Ledger?

So the following time you see your self scratching your head over a mysterious transaction, keep in mind that suspense accounts are right here to save the day. Maybe solving accounting mysteries will even turn into your new favourite thing. Sometimes, cash lands in your checking account, and you have no clue who sent it or why. A suspense account is the perfect place to park that fee while you investigate. Transactions with lacking details, unidentified payments, partial payments, or discrepancies typically go into the suspense account quickly. This process keeps your data correct and ensures the suspense account stays momentary, not permanent.

- BlackLine Journal Entry is a full Journal Entry Administration system that integrates with the Account Reconciliation product.

- Accordingly, there should be a day by day measurement of the balance in the suspense account, which the controller makes use of because the set off for ongoing investigations.

- There is simply one technique to determine this when you can not confirm who sent you the fee.

- The revenue and loss accounts categorize the gadgets as both expenses or earnings.

- Make certain to document as a lot information as possible—date, amount, and any reference numbers.

Suspense accounts in a company’s basic ledger usually include entries where there are uncertainties or discrepancies that need to be resolved. For example, if a buyer writes an incorrect account quantity on a fee, the money goes into a https://www.simple-accounting.org/ suspense account till corrected. One Other instance is when a buyer pays with out specifying which bill to credit, putting the funds in a suspense account.

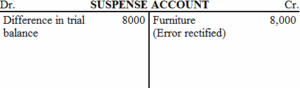

If the credits in the trial balance are bigger than debits, report the distinction as a debit. If the debits are bigger than credits, report the distinction as a credit. A general ledger is the place a business information its belongings and liabilities on an ongoing foundation, damaged into separate classes or accounts. To close the suspense account, credit the suspense account and debit the provides account for the buying department. The profit and loss accounts categorize the items as either expenses or revenue. The item will be sent to a brief account often known as the suspense account if there might be any doubt relating to identification.

After you make the ultimate fee and obtain the merchandise, shut the suspense account and open a separate asset account. If you don’t know who made the fee, take a look at your outstanding buyer invoices and discover which one matches the payment amount. Contact the shopper to confirm that it’s their cost and the best bill.

Payroll suspense doesn’t imply your company’s payroll is held; paychecks are nonetheless issued and your money account is adjusted to indicate this cost. (b) The steadiness sheet accounts prescribed in this system of accounts for each air carrier group are set forth in Part three, Chart of Steadiness Sheet Accounts. The stability sheet parts to be included in each account are introduced in section 6. Passengers and cargo transported by air for which no remuneration or token service charges are acquired by the air service.

Check out our article to see whether or not paying your mortgage funds with a bank card is value it. Bank Card Insider receives compensation from some bank card issuers as advertisers. Also, you’ll have the ability to simplify and automate the method utilizing Dancing Numbers which is ready to help in saving time and rising efficiency and productiveness.

Completing the Gross Sales Tax Return creates a two-line Journal Entry that simply moves what you owe (or what’s owed to you) from GST/HST Payable to GST/HST Suspense. If you create a Payment for that interval, you’re crediting your checking account and debiting the GST/HST Suspense account. If you create a Refund for that period, you’re debiting your bank account and crediting the GST/HST Suspense account. The suspense account can hold the distinction that led to the trial stability not balancing until the discrepancy is rectified. Accordingly, there must be a every day measurement of the stability in the suspense account, which the controller uses as the trigger for ongoing investigations.